1. Purchasing insurance from one of the most competitive carriers in your class code; and

2. Receiving the maximum scheduled credits from your carrier.

These two cost-cutting measures can be easily accomplished by doing the following 3 things:

1. Lower your EMR

The good news is that you CAN completely control and even lower your company’s EMR by:

- Implementing an effective safety program;

- Creating a 12-month strategic training calendar;

- Auditing on a regular basis;

- Managing claims proactively; and

- Compiling monthly reports on all your safety activities.

By improving the effectiveness of your company’s safety practices and programs you will lower your EMR and make your company more marketable to insurance carriers.

Read: How EMR Can Improve Business Performance >>

2. Avoid Hiring Your Next Accident

- Conduct a Pre-Placement Physical at an Occupational Health Clinic. The cost of a pre-placement physical is a minor expense compared to the cost of a claim! The physical should include an alcohol and a 5-panel drug test.

- Implement a thorough New Hire Orientation ensures that your employee understands your company’s rules and regulations. You also need to get their signature of acknowledgement for your OSHA defense file.

- Develop a clear Claims Management Procedure that identifies who gets the first call when an accident occurs; who conducts the accident investigation; and who collects Supervisor Incident Reports, Employee Incident Reports, Witness Statements, and DWC-1 Claim forms

- Keep incidents First-Aid, instead of OSHA recordable, if at all possible. A trip to the Emergency Room can kill your bottom line, not to mention, negatively impact your insurance costs for years to come.

- Fight fraud aggressively by staying on top of each claim. Sometimes injured workers need to be reassured that they will be taken care of financially if their claim goes loss time. Know what signs to look for so you can sniff out fraud right away.

Read: Claims Management 101 >>

3. Create a Safety Culture

For this reason all companies should focus on creating a safety culture. In a strong safety culture, employees are empowered to identify and correct safety issues at all levels.

A “Say It When You See It” philosophy is key to creating a safety culture. For example, an apprentice feels comfortable walking up to a foreman and reminding them to wear their safety glasses. This behavior is not only encouraged, it’s rewarded in a strong safety culture.

How can a company instill a safety culture? They can adopt the four “E’s” of a SMART Safety Culture, which are:

- Establish safety as a core value

- Empower everyone

- Elevate safety advocates and eliminate opposition

- Exhibit a commitment to safety in all actions.

Learn practical steps you can take in order to establish a SMART safety culture at your company.

Read: The Four E’s of a SMART Safety Culture >>

In Conclusion

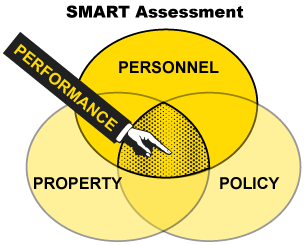

SMART Assessment

If you need help, contact us for a SMART Assessment. The SMART Assessment is designed to provide critical 3rd party feedback on your safety program. Our recommendations are designed to help you turn your safety program into a Profit Center instead of a Liability. Contact Us if you are interested.